How to Calculate Gratuity in UAE (2025) | Step-by-Step Guide

In the UAE, gratuity is calculated on an employee’s basic salary and number of years worked for the company. Workers get paid 21 days per year for the first five years they work, and 30 days a year after that. Multiply the days by your wage per day in order to calculate your EOSB.

You are an employee, and at any time you will most likely leave your job. This could be realizing, you want to try something different perhaps change of amnion, retirement or the magic W word, ” What next”.

Nevertheless, regardless of the cause, employers are required to pay you a gratuity at the end of service as a matter of UAE labor law.

But, calculating the tips can be quite a challenge. To make things easier, we have put together a guide on how you can calculate your gratuity in the UAE.

We’ve also added a very simple and accurate Gratuity Calculator that allows you to instantly calculate the Employee’s End of Service Calculation as per UAE Labour Law, along with a Salary Conversion Tool that let you convert your Monthly Salary, Annual Salary or other Pay Rates in different currencies.

in the U.A.E is more than a goodbye bonus — rather, it’s a legal requirement that offers financial security to employees as they change jobs or prepare for retirement. Why is gratuity calculation in the UAE important Not only is it a notion of fairness with both to employees and HR specialists, but it is also a legal requirement under UAE Labour Law Federal Decree No. 33 of 2021 that enables an employee to receive rewards at the end of their employment.

In this in-depth guide, we will tackle everything you should know when it comes to UAE gratuity calculation, as we will show you the new formulas, real examples, a free calculator and frequently asked questions. If you are mapping out your career move or ensuring compliance as an employer, it is important to have an understanding of UAE gratuity law for successful navigation of the country’s employment environment.

Table of Contents

What Is Gratuity?

Gratuity (End of Service Benefit) Gratuity, or end of service benefit, is a lump sum amount offered to an employee based on the duration of service. Consider it a reward for years of loyal service and a chunk of money to help you financially transition during career changes.

Companies gratuity to the run with Dubai with pay labour law and in acknowledgment employees contributions. This entitlement provides that workers having attained a stipulated length of service will receive benefits based upon such service, which results in durable employment relationships and affords economic security.

UAE Gratuity Rules (2025 Update)

The revised labour law in the UAE has made your gratuity even easier but protects you as an employee. Here are the basic things all employees and employers need to know:

Basis of Computation:

Tip is computed only on basic wages. No housing allowances, transport allowances, or other perks are taken into account, to keep it simple and transparent for the entire employment market.

Service — One Full Year of Service Required:

To be eligible for a gratuity payment, you must have at least a year of service. Partial years are prorated, so if you leave after 18 months, you’ll receive gratuity for one full year and a pro-rata amount for the remaining six months.

Resignation Rights:

As per the new law, employees who resign can no longer have a gratuity deduction. Before you could not be fully gratified with resignation; now you are entitled and will be gratified in full for sure whether by the employer or the employee.

Maximum Limit:

Maximum amount which can be paid as gratuity is limited to the total salary for 2 years i.e. (Basic +DA) X26. This cap ensures that there are not stupidly high pay outs even as long serving employees benefit significantly.

Who Is Eligible for Gratuity in UAE?

Gratuity entitlement for employees not all employees are entitled to gratuity payments under the labor law of the UAE. The Gratuity Benefit shall be subject to the fulfillment of the following requirements:

- There has to be a labor contract of employment(limited or unlimited).

- The employee has worked without an interruption for at least one year or more for an employer

An employee under a contract with an indefinite duration will not be entitled to receive an end-of-service award where the employee resigns without notice, fails to prove that the employer has failed to comply with its obligations, or fails to prove such abuse at the hands of the employer or its agent.

Both expatriates and Emiratis are entitled to gratuity

An employee terminated under Article 120 of the UAE Labour Law on account that they have failed to adhere to what has been mentioned in the Article may not be entitled to the gratuity.

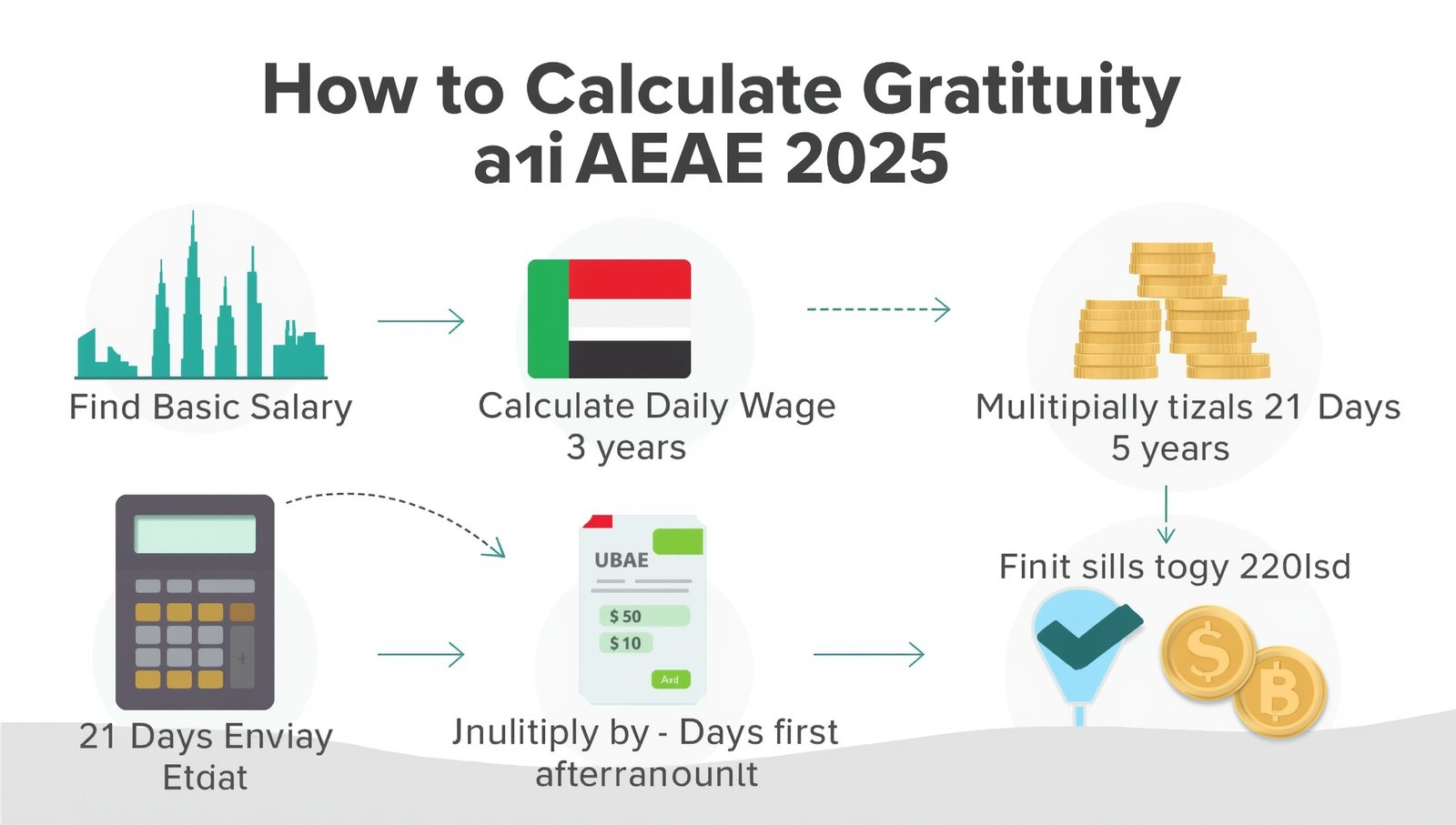

How to Calculate Gratuity in UAE (Step-by-Step)

Step 1: Locate Your Basic Salary

It is stipulated in your contract of employment that you have basic salary and this is on what the gratuity is based. Find the “Basic Salary” entry, which should be listed separately from allowances such as housing, transport or communication allowances. Here’s an example: “You will need to mention only the basic component in your open statement while calculating gratuity.” For instance, if your total package is AED 15,000, with a basic salary of AED 10,000 and AED 5,000 as allowances component, take only the AED 10,000 for gratuity equation.

Step 2: Calculate Daily Wage

This simple calculation will convert your monthly basic pay to the daily rate:

UAE labour law adopts a month of 30.4375 days for all calculations. This ensures uniformity and fairness in the employment relationship.

Step 3: Apply Service years Formula

The UAE has a two-tier model when it comes to gratuity days:

This progressive system recognizes longevity with the company, offering enhanced benefits to employees who remain loyal beyond five years.

Step 4: Combine Results

Add together your totals for the first five years followed by your totals for your second year and ensuing years to find the total amount of gratuity to which you are entitled. For less than full year, compute pro rata for whole months of service.

UAE Gratuity Calculation Formula (Quick Reference)

Formula Box

Example Gratuity Calculation

Let’s calculate gratuity for Ahmed, who worked 7 years with a basic salary of AED 10,000:

| Years of Service | Basic Salary (AED) | Days per Year | Total Gratuity |

|---|---|---|---|

| 5 years | 10,000 | 21 | 35,000 |

| 2 more years | 10,000 | 30 | 20,000 |

| Total | 55,000 |

Detailed Breakdown:

- Years 1-5: 10,000 × 0.7 × 5 = AED 35,000

- Years 6-7: 10,000 × 1.0 × 2 = AED 20,000

- Final Amount: AED 55,000

UAE Gratuity Calculator

Use this interactive calculator to determine your gratuity amount instantly:

Calculator Instructions:

- Enter your monthly basic salary (exclude allowances)

- Input your total years of service

- Add any partial months

- Click calculate for immediate results

Note: This calculator uses the standard UAE formula and provides estimates. Always verify with your HR department for final calculations.

Special Cases in UAE Gratuity Law

Limited vs Unlimited Contracts

Open Ended Contracts: The contract under which gratuity is computed under the 21/30 days rule irrespective of duration of the contract or resignation etc.

Restricted Contracts: Contracts with a specific period of time that remains fixed for gratuity calculation but employees must know the impact of renewal terms on their continuous service calculation.

Resignation Cases: Per the new UAE labour law, resignation has no impact on your gratuity. Should you resign or should your employer dismiss you (not including gross misconduct), you will get the full calculated figure. This move also allows more job flexibility and financial security for workers in the UAE.

Termination Cases

Discretionary service charge may be impacted in instances of gross misconduct, such as:

Especially on termination, written notice and proper disciplinary procedure should be followed prior to either reducing or stating there are no gratuities.

Common Mistakes Employees Make

Not Checking Basic Salary Clause

Total package is often misinterpreted by many employees who refer to basic salary. 1] Ensure your contract breaks down basic pay and allowances clearly as that has a direct bearing on your gratuity computation. If the disbursement isn’t explicit, ask HR what you can spend the money on.

Canon Financing Allowances and Bonuses are not the Same as Gratuity

Dear Tapan Allowances such as housing, transport and communication benefits are not to be considered for the calculation of gratuity. Annual, overtime and commission payments are also independent of end of service gratuity.

Forgetting Unpaid Leave Deductions

Long leaves without pay would affect your effective service for gratuity. Note down any unpaid leave which is more than the normal approval and consider how it can affect your last settlement.

Assuming Contract Type Affects Calculation

The gratuity calculation formula is the same whether you are on a limited or unlimited contract. The contract has an impact over other job conditions, but does not influence the way in which the basic loan amount is calculated.

Final Thoughts

Knowing how to calculate your UAE gratuity helps you make more informed career decisions but it also makes sure you’re getting what’s owed to you in full, legally. Be sure to confirm these calculations with MOHRE or your company’s HR department.